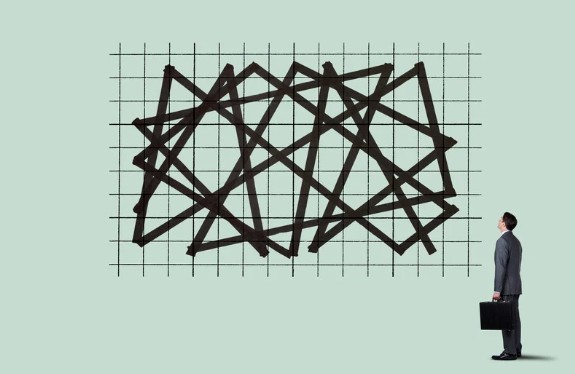

Early Volatility: Navigating Market Uncertainty

In the first half of 2026, expect increased market volatility. This is a typical pattern during midterm years as investors react to uncertainty surrounding election outcomes and potential policy shifts. Stock markets often struggle in the early months, but this temporary dip can provide savvy investors with an opportunity to buy undervalued stocks.

Historically, markets tend to recover sharply in the 12 months following midterm elections, with the S&P 500 averaging an impressive 16.3% return. Bond markets will also likely see fluctuating yields, with short-term bonds underperforming in the first half, followed by stronger performance in the latter half of the year. For investors, this offers a chance to adjust portfolios and take advantage of the changing market conditions.

Sector Performance: Defensive Stocks Shine

Certain sectors tend to perform better than others during midterm years. Defensive sectors like healthcare, consumer staples, and utilities typically outperform the broader market. These industries offer stability and consistent returns, making them ideal for investors seeking safety in uncertain times. If you’re looking to protect your investments during the early volatility, these sectors may provide the security you need.

The Political Impact: Gridlock and Executive Power

The results of the 2026 midterm elections will likely lead to a shift in the political landscape. If Republicans lose their narrow majority in the House, legislative gridlock is a real possibility. This will make it harder for President Trump’s administration to pass major growth-focused policies like tax cuts and new spending initiatives.

In a gridlocked Congress, the President is expected to lean more on executive powers. This could mean increased reliance on tariffs and regulatory changes to push through key policies, especially those focused on trade and national security. While this approach may not lead to sweeping new laws, it could create an unpredictable environment for businesses and investors, especially in industries like manufacturing, energy, and healthcare.

Voter Sentiment and Policy Focus

As of early 2026, public sentiment is divided, with voters prioritizing affordability, inflation, and healthcare costs. These issues are likely to dominate campaign speeches and discussions throughout the election cycle. While Democrats hold a slight edge over Republicans on economic issues, the political battle is expected to be tight, with both parties trying to win over key voting blocs concerned about rising living costs.

The outcome of the elections will also have significant implications for key areas of policy. With inflation continuing to be a top concern, voters will be looking to Congress to take action on lowering costs for everyday goods and services. Expect to see debates around healthcare reform, tax policy, and social spending programs heat up as the elections approach.

How Investors Can Prepare for 2026 Midterm Uncertainty

- Diversify Your Portfolio: Given the expected volatility, diversifying across asset classes is essential. Consider allocating more into defensive sectors like utilities, healthcare, and consumer staples, which have historically weathered midterm election volatility well.

- Monitor Political Developments: Stay informed about key legislative and executive actions that could affect your investments. Pay attention to trade policy changes, particularly regarding tariffs, which could impact sectors like manufacturing and agriculture.

- Watch for Policy Shifts: As gridlock sets in, the administration may rely on executive orders, particularly in areas like healthcare and energy. Monitor these changes closely, as they could lead to significant regulatory changes that affect the markets.

- Plan for Long-Term Growth: While the first half of 2026 may be marked by volatility, the second half of the year could offer solid opportunities for long-term investors. Stay focused on growth sectors and consider expanding your holdings when the market recovers.

Historical Trends: What to Expect Post-Election

Looking at past midterm elections, we can predict that once the uncertainty settles, the markets will likely rebound. In the post-election year, the S&P 500 has historically seen much stronger performance, with an average return of 16.3%. If history repeats itself, investors who remain patient during the early months could see substantial gains.

Key Takeaways:

- Pre-Election Volatility: Expect some early turbulence in 2026 as markets react to election uncertainty.

- Post-Election Rebound: Historically, the markets tend to perform well after midterms, with an average of 16.3% returns.

- Sector Performance: Focus on defensive sectors like healthcare, consumer staples, and utilities for stability.

- Policy Gridlock: A potential Republican loss in the House could lead to legislative gridlock, shifting the focus to executive action.

- Voter Focus: Affordability, inflation, and healthcare costs are likely to be the top issues in 2026.

FAQ’s

1. U.S. Economy Under Biden vs. Trump

The U.S. economy under Biden has seen a recovery from the pandemic, with a focus on economic stimulus, job creation, and climate policies. Trump’s tenure saw tax cuts, deregulation, and a focus on trade policies. Both presidents had different approaches, but both periods experienced notable economic growth and challenges.

2. Current State of the Economy

The current economy is navigating inflation, rising interest rates, and a potential recession. However, unemployment remains low, and job growth continues, though inflationary pressures are still a concern for many consumers and businesses.

3. Trump vs. Biden Economy 2025

In 2025, the economy under Biden is likely to see continued focus on sustainability and social programs, with challenges from inflation. Trump’s economy, if re-elected, could emphasize tax cuts, deregulation, and potential tariffs to boost growth, but it could face hurdles from legislative gridlock.

4. 2026 Stock Market Projections

The stock market in 2026 is expected to experience volatility due to midterm elections and potential legislative gridlock. However, historically, the market has shown significant recovery in the year following midterm elections, with the S&P 500 averaging 16.3% growth.

Conclusion

The 2026 midterm elections will significantly shape U.S. policy and the economy. Early volatility is expected, but a market rebound in the latter half presents investment opportunities. Potential gridlock in Congress could shift power to the executive branch, leading to impactful regulatory changes. Staying informed on political and economic shifts will be key for both voters and investors to make smart, strategic decisions.